Okay, so China will be launching its own state-backed cryptocurrency in the coming months. Going by reports from various news outlets, the cryptocurrency will be received by Industrial & Commercial Bank Of China, The Bank Of China, The Agricultural Bank Of China, Alibaba, Tencent and an Association of Chinese Banks. We all know China has been trying its best to ban the use and mining cryptocurrencies by Bitcoin and Ethereum in its country. Alongwith ban on the use of multiple large social media and Internets Services such as Facebook & Google. Though the irony is, that 70% of cryptocurrency mining is done in China.

It also raises a question, as to why is there a need for segregation over government and non-government issued cryptocurrency. As the main promise of a cryptocurrency lies in it being a decentralized system. But, who issues the cryptocurrency also has a huge impact on its mass adoption and use by the people.

It is a known fact, that a cryptocurrency launched by Chinese government, will be a centralized one. Also, the cryptocurrency will only replace the cash in circulation, not the one which would generate credit and impact monetary policy. The usual story that China may state will be of cryptocurrency being launched to tackle bribing of government officials and physical currency being expensive and cumbersome to produce.

What I feel like is that China announcing and launching a cryptocurrency in such a short notice is partly due to pressure from Facebook’s Libra cryptocurrency. Although Facebook is officially banned in China, many Chinese maintain Facebook accounts using sophisticated VPNs to vault ignore China’s firewall. People’s Bank of China has also said that Facebook’s Libra must be put under central bank oversight to prevent potential foreign exchange risks and protect the authority of monetary policy.

One key difference according to reports by news outlets is that while libra is being designed to handle 1,000 transactions per second, the DC/EP was designed to handle 300,000 transactions per second. For the sake of context, during last year’s Singles Day (China’s biggest holiday), the peak volume of all transactions in China was 92,771 transactions per second.

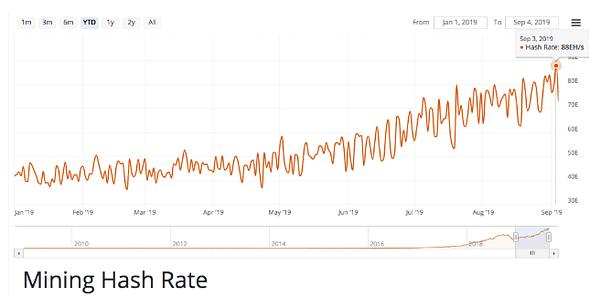

Add to it the fact that many Chinese who have been considering Hong Kong a safe haven for their money are now reconsidering of where to stash their cash owing to the protests in Hong Kong. That too, a bit more far away from China in case the government becomes a bit more hostile towards stashing of money and assets. And one of the medium for offshoring these assets includes bitcoin and other cryptocurrencies.

Also, there might be an even greater push to privacy-focused cryptocurrencies such as Bitcoin, Monroe & Cardano as there will be Chinese’ who will immediately recognise the dangers of using a government-issue cryptocurrency which is immediately traceable.

Whatever be the case, I feel China has taken a very bold step towards converting its national currency into a cryptocurrency, which will be allowing their currency to virtually cross over the limits of international borders. Donald Trump should be very worried right now about the stature of USD as a global reserve currency, and start owing up rather than playing the blame game with federal reserve.

Selected Headlines: So that you don’t have to

The Chicago Mercantile Exchange (CME Group) announced its intention to increase in the spot month position limit for its bitcoin futures contracts in a letter to the U.S. Commodity Futures Trading Commission (CFTC) Thursday.

Bitcoin.com is preparing to launch a futures contract for Bitcoin Cash ($BCH).The move is aimed at making BCH the second-or third-largest crypto by market cap “within a year,” he said, adding: “To get from No. 4 to No. 3 or No. 2, we have to see more volume.”

European governments are working on plans to launch a public digital currency in response to perceived threats by private digital currencies. The project is intended to allow consumers to use digital cash, deposited at the ECB, without the need for bank accounts or other financial intermediaries. This announcement comes after EU authorities explicitly mentioned the threat that Libra poses to consumers, financial stability and even "the sovereignty of European states."

Spanish Bank Santander issued a $20M bond directly onto the Ethereum public blockchain, where it will remain until the end of its one-year maturity. Both the cash used to complete the investment and the quarterly tokens were tokenized.

Coinbase may soon launch an Initial Exchange Offering Platform. Coinbase head of institutional sales in Asia, Kavyon Pirestani said an initial exchange offering (IEO) platform is one of several capital-formation tools currently being explored by Coinbase.

Thought Starters

All major banks want to know your location.

They are devaluing against air basically

It’s all just change of hands, “What Goes Around, Comes Around”

HODL! HODL! HODL!

Also, you can order pizza globally

Beyond till the Shining Stars

BEST TWEETSTORM OF THE WEEK

Do Your Part: Buy Bitcoin Today

MY Week Summed Up

This week I hosted Eric Alexandre Ceret (Founder of Jetcoin) on HashTalk with Sankalp podcast. We discussed how he went from being a fashion photographer to a blockchain entrepreneur, what he has learned while being involved in such diverse industries and what is his learnings. Listen now on Google Podcasts > Click Here

Is the recession triggered armageddon just round the corner, and is bitcoin our only saviour? Listen my narrative for this week “Recession Armageddon v/s BTC” on Google Podcasts. Click Here

Also check out my blog “Undoing Global USD Dependency With Bitcoin” on Altcoin Magazine here.

P.S. HashTalk with Sankalp is now available on all the major podcast channels including Apple Podcasts, Spotify, Google Podcasts, iHeartRadio, PocketCasts and many more.

Curated Articles of Past Week: Best of the Best

Runaway Story or Meltdown in Motion? The Unraveling of the WeWork IPO - Aswath Damodaran

Pax Bitcoiniana: After The Last Country on Earth - Felipe Gaúcho Pereira

Derivatives in Crypto - Jack Purdy

Whither Skynet? An American “dead hand” should remain a dead issue - Luke O’Brien

The Uphill Battle LAOs Will Face - Mohamed Fouda

Top Listen: Best of the Best Podcast

How Cryptocurrencies Could Threaten the State - Ep.90 - Unconfirmed

Share the Love, Have a Great Week Ahead!

Connect with me

Twitter • LinkedIn

Disclaimer: None of the content in this newsletter is meant to be financial advice. Please do your own due diligence before taking any action related to content within this article.